Avia Labuan Foundation Group was established in 2023 as a single-family office based in Selangor. While its primary focus remains on preserving the family’s wealth through a diverse investment portfolio, Avia is intentionally structured to blend commercial success with a strong commitment to social impact. Central to this approach is their pledge to allocate one-sixth of their profits to philanthropic endeavours, embedding giving into its core structure. This commitment also profoundly influences their investment strategy and partnerships decisions.

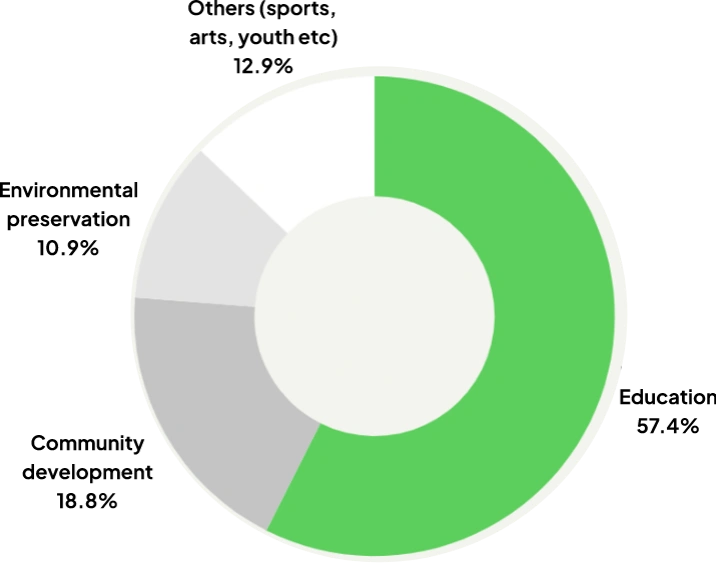

Inspired by the founder’s humble beginnings and a strong belief in the transformative power of education, Avia prioritises initiatives that address educational and social welfare needs, particularly for underserved communities, using funds allocated specifically for philanthropic efforts. This commitment is exemplified when Avia exited one of its investments that generated a 5x return. Rather than taking any profit, they kept only the principal and donated all profits to a local university to fund a 0% interest student loan program. Recognising the importance of responsible deployment, Avia ensured that the university established robust governance and due diligence procedures for the program. The program’s success, marked by a high repayment rate and near-zero default rate, demonstrates the effectiveness of well-governed micro-loans in alleviating temporary financial hardship and promoting greater access to education.

The one-sixth mandate requires a careful balance between financial goals and a genuine desire to create positive social change. Avia integrates ESG and impact considerations into their commercial investment decisions whenever possible, prioritising opportunities that tangibly benefit communities when commercial prospects are similar. As a relatively new entity, Avia acknowledges that their journey is ongoing. While actively seeking to expand their network, they remain committed to exploring effective methods for assessing the broader social and environmental impacts of their investments.

Avia’s narrative demonstrates how a clearly defined commitment can shape investment decisions and create a firm foundation for impactful action. This case underscores the critical role of clearly defined structures with robust governance in ensuring that impact missions are consistently achieved. It also highlights the importance of establishing a clear mandate, charter and mission statement, ensuring that impact is embedded in every decision.